Get Ready for the UAE’s E-Invoicing Revolution

The UAE Federal Tax Authority (FTA) is introducing a national e-invoicing system that will replace traditional paper and PDF invoices with structured electronic formats.

Starting July 2026, large enterprises and SMEs will be required to issue, exchange, and store invoices digitally — ensuring real-time reporting, transparency, and compliance.

Failing to prepare early may lead to disruptions, penalties, or delayed VAT filings.

Key requirements for an e-Invoice to be valid in the UAE

Structured formats: eInvoices must be in a quickly accessible digital format, such as XML or JSON.

Complies with government standard: eInvoices must be in a structured data format that adheres to the government’s regulations. These standards are documented in a data dictionary released by the UAE’s Ministry of Finance, PINT AE to guide service providers to build compliant solutions for UAE’s eInvoicing and for businesses to assess their choice and processes. This document lays out the requirements for the processes involved in eInvoicing including generating, exchanging, processing, and reporting.

Real-time reporting: eInvoices must be transmitted to an Accredited Service Provider (ASP) in real time via the Peppol Network. Peppol (Pan European Public Procurement Online) is a global infrastructure that is used to securely transfer electronic documents, especially eInvoices, in the public sector.

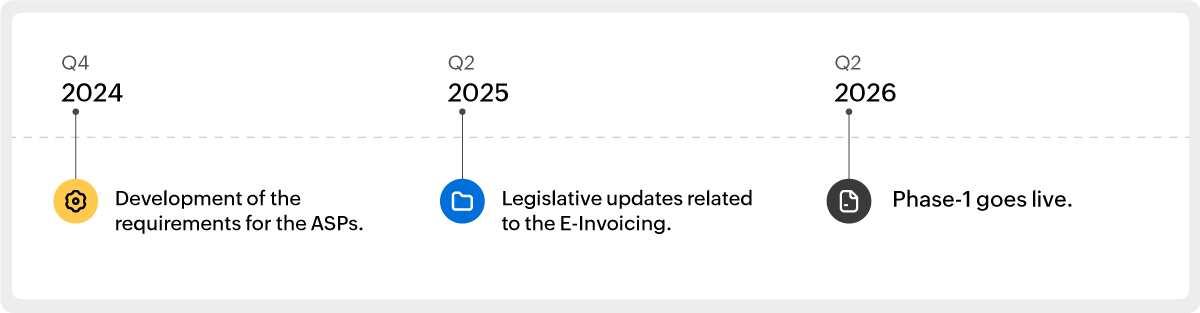

Timeline: e-Invoicing in the UAE

Phase | Category | Deadline to Appoint ASP | Mandatory Implementation Date |

Pilot Programme | Selected businesses (Taxpayer Working Group) | Not Applicable | 1 July 2026 |

Voluntary Adoption | Any business (optional) | Flexible | From 1 July 2026 |

Phase 1 | Large businesses with revenue ≥ AED 50 million | 31 July 2026 | 1 January 2027 |

Phase 2 | Businesses with revenue < AED 50 million | 31 March 2027 | 1 July 2027 |

Phase 3 | All UAE Government Entities | 31 March 2027 | 1 October 2027 |

e-Invoicing Process in UAE

To comply with the UAE’s e-Invoicing mandate, businesses will need to follow a structured process supported by their ERP systems and Accredited Service Providers (ASPs). Here’s how it works in practice:

- Hire an Accredited Service Provider (ASP): Businesses must appoint an FTA-accredited ASP. The ASP works with your technical/ERP team to customize your ERP so that it can capture all relevant invoice data fields required by the FTA (often called the “data dictionary”).

- Map ERP Data to Standard Fields: Each e-invoice requires specific information such as seller/buyer details, VAT registration number, item description, taxable amount, VAT rate, total invoice value, etc. The ASP ensures your ERP is aligned with this data dictionary and maps the captured fields correctly.

- Convert to Required Format: Once details are entered in your ERP, the ASP’s core system converts the invoice into the mandatory digital format (XML or JSON) using approved standards like UBL or Peppol PINT.

- Validate and Enrich: Before sending, the ASP validates the data, corrects errors if any, and enriches the invoice with missing mandatory fields (such as standardized codes or unique identifiers) to ensure compliance.

- Real-Time Transmission: The ASP then transmits the invoice simultaneously to

- The FTA’s e-Billing system, for monitoring and compliance.

- The buyer’s ASP, so the recipient receives the invoice in a processable format.

- Secure Storage and Access: Both the issuer and recipient must securely store the e-invoice and related data inside the UAE as per FTA rules. Invoices remain accessible through the ERP or ASP portal for audits, reconciliations, and VAT filings.

e-Invoicing Exemptions in UAE

Certain categories of transactions are excluded from mandatory e-invoicing under Article 4 of Ministerial Decision No. 243/2025:

- B2C transactions are not subject to mandatory e-invoicing

- Transactions conducted by government entities in a sovereign capacity that are not in competition with the private sector.

- International passenger air transport services where electronic tickets are issued.

- Ancillary airline services linked to passenger transport when an Electronic Miscellaneous Document (EMD) is issued.

- International transport of goods by air, where an airway bill is issued. This exclusion applies for a limited period of 24 months from the system’s effective date.

- Financial services that are VAT-exempt or zero-rated.

- Any other transactions determined by the Minister of Finance.